About Course

Master the concepts of Indian Payroll to become a Certified HR Payroll & Compensation Specialist with our Online Certification Course on the Indian Payroll System and Income Tax on Salaries.

Gain a detailed understanding of allowances, perquisites, and income tax components to facilitate efficient management and achieve strategic business goals.

Salient Features

Benefits

- Understand The Ins And Outs Of Employee Management And Job Responsibilities.

- Develop A Sound Understanding Of Provident Fund Laws, PT, ESI, LWF, Gratuity Rules, Superannuation Schemes, Investment Options, Etc.,

- Learn Efficient And Strategic Approaches To Payroll Management, Including Fixed And Flexible Payroll Structuring.

- Get Higher Pay And Faster Promotions With Advanced Knowledge Of Payrolls, Taxes, And Calculations.

- Gain Exposure To Various Niches And Be Eligible For Employment Opportunities In The Global Market.

- Become An Integral Asset In One Of The Most Competitive Job Markets.

Takeaways

- 20 Hours Of Action-Oriented Online Learning

- Guaranteed Opportunities For Career Growth

- Practice Materials and DIY Toolkits

- Recorded Videos Of All Sessions

- Completion Certificate

- Post Course Completion Online Assessment for Certification

- Certified Payroll Management Certificate

Who Can Join?

- Payroll & Compliance professionals

- HR Professionals With Varying Levels Of Experience.

- Non-HR Managers In Entrepreneurial Or Top Management Roles

Course Flow:

| PROGRAM SCHEDULE: | LIVE LEARNING - PREMIUM PLAN | SELF PACED LEARNING - STANDARD PLAN | ||||||||||||||||

| Program Start | November 19 Tuesday, 2024 | On the day of Enrollment | ||||||||||||||||

| Course Duration | 60 + Days with lifetime access | 60 + Days with lifetime access | ||||||||||||||||

| Weekly Time Commitment | 1.5 Hours (Live+ Online) | 1.5 Hours (Online) | ||||||||||||||||

| Live Sessions |

| |||||||||||||||||

| Course Regular Fee | INR 9000/- | INR 5000/- | ||||||||||||||||

| Early Bird-cum festival offer | INR 4500/- ONLY FOR TODAY | INR 2597/- ONLY FOR TODAY | ||||||||||||||||

| Admission Process | > Complete Your Enrollment > Video Orientation > Start Learning | > Complete Your Enrollment > Video Orientation > Start Learning | ||||||||||||||||

FEE PRICING: What you are getting for a small amount of spending for your lifetime learning

←ENROLL NOW→

[Syllabus]

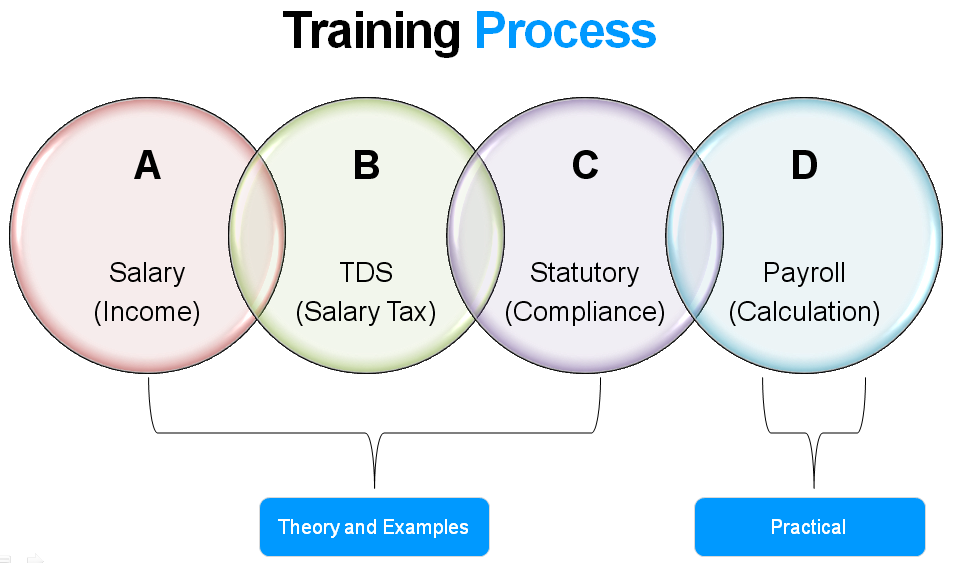

This course is structured into Five modules. The basic structure of the courses is as follows:

| MODULE-1: OVERVIEW OF COMPENSATION & PAYROLL MANAGEMENT | |

| Lesson -1 | The Role of Payroll Department in an Organization - Payroll Management, Introduction of HRM, HR Planning for "Payroll Budget", Compensation Management and Salary Administration, Employee Transfer and Promotions, Performance Appraisal and Increment Process. |

| Lesson -2 | Income Under The Head Salaries u/s 17(1) of Income Tax Act, 1961 - Meaning of Salary, Wages, Annuity and Retirement benefits, Allowances and type of Allowances , Valuation of Perquisites and Taxability of Perquisites , Retirement benefits. |

| Lesson -3 | Salary Components in terms of Fixed and Variable - Setup Payroll Administration and Functions, Structure of cost to company - CTC Appendix, Bonus Payment and Treatment of Bonus, Fee and Commission and Overtime Payment, Taxable and Non Taxable Payments (Exempted). |

| Lesson -4 | Claim and Reimbursement Management - Claim Management Module, expense bills Submission, Medical Reimbursement and Travel Reimbursement, Type of Reimbursements, Disbursement of Claim Reimbursement. |

| Lesson -5 | Attendance Management System and Resignation (Full and Final) of Exits - Time Management System, Leave Management System, Type of leaves and Leave without pay Calculation, Full and Final Settlement Input and Calculation. |

| MODULE-2: COMPENSATION & BENEFITS DESIGN | |

| Lesson -1 | Total Rewards- Understand total rewards concepts, its components & advantage of total rewards program for Organisation |

| Lesson -2 | Compensation Pay Structure Design - Design a band based & Grade based Pay structure, Job Analysis, Job Evaluation, Job families Creation. |

| Lesson -3 | Pay Policy Design - Design a lead, lag or meet based pay program, Compensable Factors for each job family. Pay survey design & benchmarking process |

| Lesson -4 | Pay Structure Creation - Create an Competitive pay structure, pay grades and pay ranges across the levels in the organisation . Visualizes an interactive salary structure |

| MODULE-3: LABOUR LAW STATUTORY COMPLIANCE AND CALCULATION | |

| Lesson -1 | Employee Provided Fund - PF - What is a covered establishment?, Who will be covered by the Pension Scheme?, PF Wages, Contribution accounts and rates, PF Deposit Date, KYC and UAN Sewa, PF Forms, ECR, Filling and Claim Settle. |

| Lesson -2 | Employee State Insurance - ESI - What is a covered establishment?, Existing Wage Limit, ESI Contribution rates and Contribution Periods, ESI cards, Deposit dates and Compliance. |

| Lesson -3 | Professional Tax - PTAX (PT) - Professional tax applicability, Professional tax slab state wise, Professional tax calculator, Professional tax payment & registration. |

| Lesson -4 | Labor Welfare Fund - LWF - Labor welfare fund applicability, Labor welfare fund rate (slabs) state wise, Where to deposit Labor Welfare Fund. |

| Lesson -5 | Tax Deduction at Source - TDS - What is Income-tax?, Income Tax Slabs and Income tax Computation, Marginal tax and computation, Last Date of TDS deposit and quarterly return , Income tax Annual return and TDS Certificate (Form 16) , Interest on late payment. |

| MODULE-4: TAX SAVING INVESTMENT DEDUCTIONS AND EXEMPTIONS | |

| Lesson -1 | Deduction (u/s 80C - u/s 80U) of Chapter VI-A of Income Tax Act, 1961 - Deductions under section 80C, Deductions under section 80D, 80E, 80U, Deductions under section 80DD, 80DDB, 80CCD2, Deductions under section 80G, 80GG, 80GGA, Deductions under section 80TTA etc. |

| Lesson -2 | Validation or Examination of Investment Proofs and Reimbursement Claims - Investment Proofs examination Under section 80C, Investment proofs examination others, Expense Bill examination of Reimbursements , Limit of Deductions and max eligibility up to Prorata , Previous Employer Income. |

| Lesson -3 | LTA, HRA, Leave Encashment and Gratuity Exemption Calculations - Leave Travel Exemption, House Rent allowance - HRA Exemption, Leave Encashment Exemption, Gratuity Exemption, Exemptions others. |

| Lesson -4 | Deduction of Entertainment Allowance and Professional Tax - Deduction of Entertainment Allowance , Entertainment Allowance is part of Tax Certificate, Deduction of Employer Tax (Professional Tax),Professional Tax is part of Tax Certificate, Other Income for Tax Deduction. |

| Lesson -5 | Deduction of Interest on Housing Loan u/s 24(b) of Income Tax Act, 1961 - Meaning of House Property, Essential conditions for taxing income under this head, Interest on borrowed capital, Standard deductions, Deductions from income from house Property [Sec.24], Calculation format and examples. |

| MODULE-5: PAYROLL PROCESSING & REPORTS | |

| Lesson -1 | Gather Payroll Inputs, Setup Employees Information in Payroll System - The Features of Payroll Processing, Employee Profile setup, Update Payroll Changes, Validation of Row data and Check Reference of Calculation flags. |

| Lesson -2 | Apply Compliances rule & Tax Rates and Determine Calculation & Deductions - Calculation variance Compliances, PF, ESI, P.TAX, LWF, TAX etc. , Tax Rate, Tax computation and One-time Tax on One-time Payment, Calculate Year to Date (YTD) of Payment and deduction, Deductions of Investment declared by Employee. |

| Lesson -3 | Verification and Payroll Checking Step by Step - Prepaying variance reports of Monthly Payroll Payout, Transformation of Payroll inputs, Attribution of head count and cost payout, Income Tax deduction and Variance of Income Tax deduction - TDS, To give maximum benefit to Employee on investment declaration, Ensure Calculation of variance Compliances, PF, ESI, P.TAX, LWF etc. |

| Lesson -4 | Salary Register, Slips, Bank Transfer and Management Information System - MIS - Overview on salary Slip and Salary Register, Management Information Reports - MIS, Variance of Payroll and Cost Center Reports , Bank Transfer to the Employee, Cost to Company Reports, Payment released offline by Cheque. |

| Lesson -5 | Prepare Statutory Reports PF, ESI, PT, ESI and TDS Form 24, Form 16 etc. - PF Contribution Reports, ESI Contribution Reports, Deduction Reports of Professional tax and Labor welfare fund, Deduction Reports of Income Tax and Income Tax variance Sheet, Prepare Form 24Q - Quarterly salary TDS return , Prepare Form 16 & 12BA - TDS Certificate. |

←ENROLL NOW→

- Certified Faculty

- Premium Professional Program

- Real Case Studies & Practice based program

Capstone Project

- Engage in collaborative learning by working with your peers

- Benefit by getting guidance from industry Experts

- Get personalized feedback on your submissions

How You Benefit From This Program

- Rigorous cutting-edge curriculum developed in collaboration with leading faculty from MNC's, HIDA & IIM

- Certification from SLA Without Quitting Your Job

- High Performance Career Coaching, access to Job opportunities, and Career Support

- Networking opportunities with peers, faculty and Industry expert

FAQ's

| Q: Can I Apply for registration through online? | |

| A: Yes. Actually, registration in Payroll Course is available through online mode only. Registration through online services of Academy is available at academy website https://aziotrandz.uteach.io/ | |

| Q: I'm a working professional, how can attend the session? | |

| A: Our program's are designed for working professionals where we focus on their development with out disturbing their official hours. Our LIVE sessions are organized once in a week in the evening after 8:00 pm. We have two learning option for you:. Therefore you have 2 options:- Option 1. Join the live class online. [Online] Option 2. Attend the classes through self-paced modules, where you will learns from video lessons as per your comfort from anywhere. | |

| Q: Can I pay fees in Installment? | |

| A: No. Student should pay whole amount in once to get all notes, course material, excel calculation sheets and daily videos from very first day and weekly live session. | |

| Q: Which payment mode do your accept? | |

| A: Student can pay fee by Online - debit card, credit card, nonbanking, UPI & PAYTM. | |

| Q: Is there any job placement assistance? | |

A: Payroll Professionals are in great demand. Companies specializing in Payroll Outhouse or human resource outsourcing are constantly hiring skilled Payroll professional. You will be also connected in a good payroll network by WhatsApp group for latest updates. |